I received a message yesterday from my brother, he bought a house. I was very proud of him knowing that he had worked hard to purchase his home. A few weeks back, a close family friend of ours also bought a house and eventually plans on renting out the rooms to help pay the mortgage and expenses as well as some extra income. Also, about the same time, my baby sister started a business that is doing well while working full-time. This had me reflect on my progress and I was less than thrilled.

Since quitting my part-time job, I have not worked on my online business. Honestly, I’ve been lazy. Procrastination has gotten the best of me. My fear of failure is the main culprit. In addition, I stopped working out and gained weight. To make matters worse, I invested my many years of hard earned savings earmarked for buying a house, in the stock market. Specifically in the technology sector…at what seems the peak! (It is advised NOT to invest your down payment in the stock market because it is volatile. You only invest if your time horizon is long, say 10 years or more)

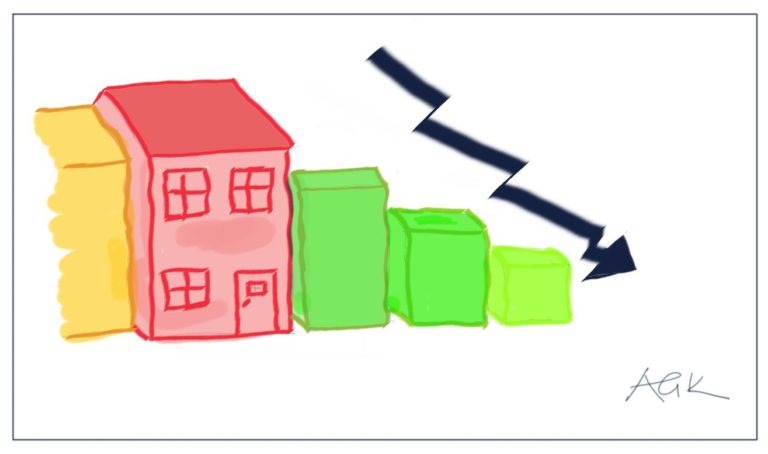

So why did I invest the down payment? Simple really…greed. Yup, I figured, the stock market has done very well (especially the technology sector), the federal government is pumping money into the economy, people are getting vaccinated against COVID-19 and the economy is opening up. Since my goal is to buy a house in three years, instead of leaving money in the bank, I thought, why not invest it and then withdraw in 3 years and pay cash.

Well, the 10 year treasury yield coughed and went up. The next thing I know. A short while after I invested a lump sum in the stock market, the technology sector is getting slaughtered! Day after day the stocks went down, I saw the money I invested fall by at least $10 per share! Needless to say, I regret that I didn’t listen to those wiser than myself.

Despite this, I do not intend on pulling out the money. I will stick to my plan and withdraw it in 3 years ONLY if I have not lost any money. I’m still contributing to my pre-tax and taxable account every two weeks. Although, for the taxable account, I’m putting half the original amount in stocks and saving the other half.

I’m proud of my family and what they’ve achieved. Their success and achievements inspire me to see the best in me and work toward my goals, despite my shortcoming.